how are 457 withdrawals taxed

Using Rule 72t to set up a schedule of SEPPs is not a simple process. If you make an early withdrawal from a qualified retirement plan the amount is added to your gross income unless you meet one of the early withdrawal.

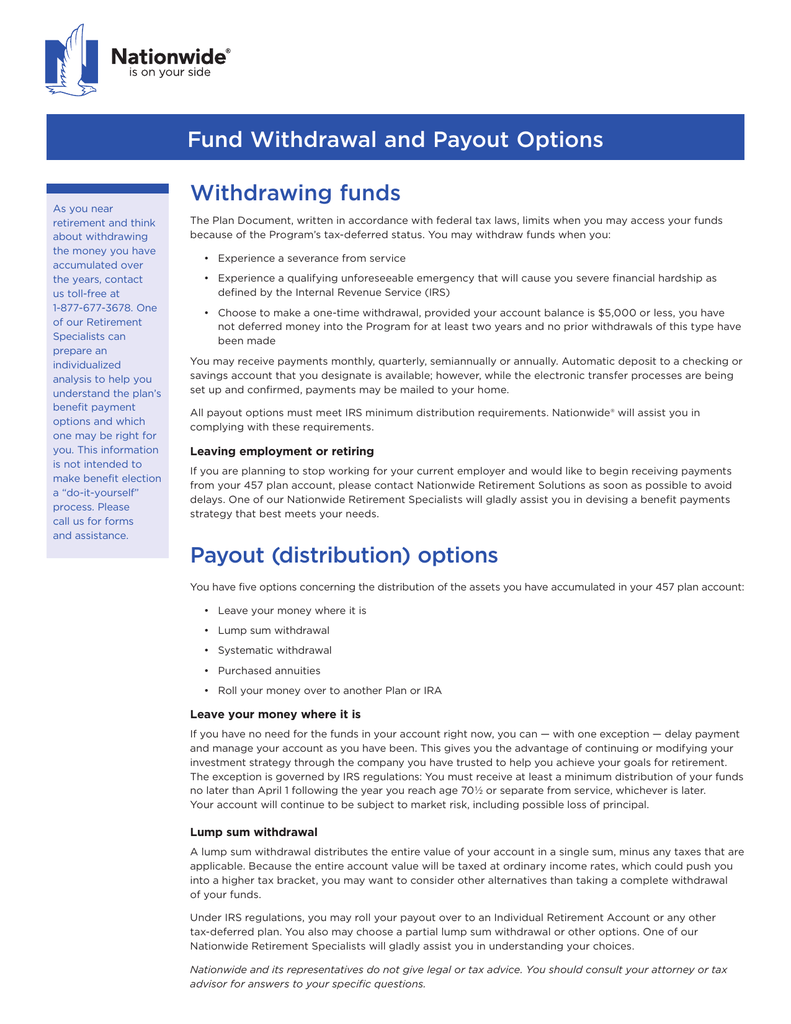

Early Withdrawals from 457s and Roth IRAs Unlike other employer-sponsored retirement plans you can withdraw money from your 457 plan before the age of 59½ without incurring a penalty.

. This included the first RMD which individuals may have delayed from 2019 until April 1 2020. That waiver expired in December 2020. Generally state or local government 457 plans are not considered qualified retirement plans and early distributions from these are not subject to a federal tax penalty though there may be state penalties.

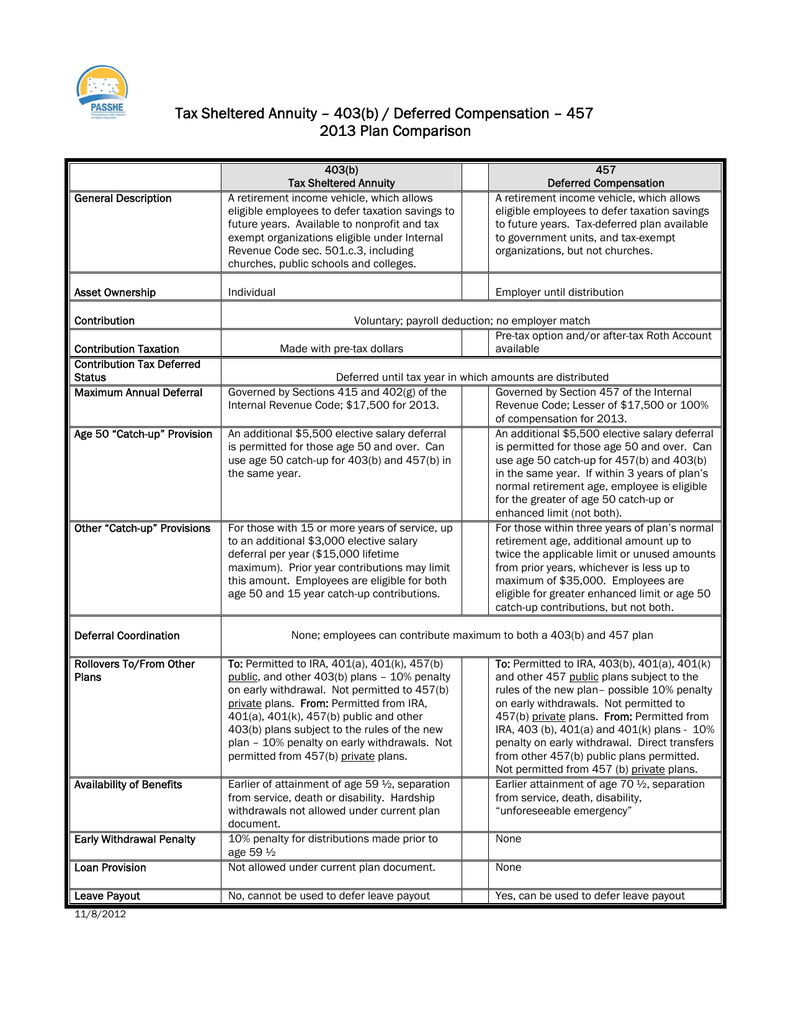

Understanding a Tax-Sheltered Annuity. Your taxes will be reduced as a. Contributions made on a pre-tax basis into the 457 and the 401k allow you to put aside a portion of your pay before federal state and local income taxes are taken out.

The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. Qualified retirement plans eligible for Rule 72t include the 401k 403b 457b Thrift Savings Plans TSPs and IRAs. In the US one specific tax-sheltered annuity is the 403b planThis plan provides employees of certain nonprofit and public education institutions with.

31 in the year following the plan owners death depending on the. NYCDCP is a retirement savings plan which lets you save for the future through easy payroll deductions. An umbrella program consisting of the 457 Plan and the 401k Plan.

If you were taking. By treating the 401k as an inherited account you may be able to begin taking minimum withdrawals from the account by Dec.

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

How A 457 Plan Works After Retirement

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Everything You Need To Know About A 457 Real World Made Easy

Options Fund Withdrawal And Payout Options

Retirement Income Calculator Faq

Using A 457b Plan Advantages Disadvantages Inspire To Fire

What Are Defined Contribution Retirement Plans Tax Policy Center

New York City Deferred Compensation Plan

Tax Consequences Tsp Withdrawals Rollovers From A Tsp Account Part 1